What Is Business Financial Statements

Finance

LAST UPDATE: NOV 19, 2022

12 minutes reading

Different timeframes may be covered by business financial statements. Annual financial statements represent the most recent fiscal year of the business. On a monthly, quarterly, or semi-annual basis, companies can also prepare interim business financial statements.

There are situations when interim statements have fewer components than year-end statements. They might not have a cash flow statement or a statement of retained earnings, for instance. Let’s learn more about financial performance, basic financial statements, business financial statements, examples, and more.

What Are Financial Statements?

Financial statements are a collection of records that demonstrate the financial standing of your business at a given period. They provide important information regarding the assets and debts of your business as well as its earnings and expenses.

The four main financial statements are as follows:

- balance sheet

- income statement

- cash flow statement

- statement of retained earnings

In order to facilitate comparisons, financial statements often include data for both the most recent period and the prior period. A financial statement for the period of January 1 to December 31, 2021, for instance, would also include the financial statements for the period of January 1 to December 31, 2020.

What Are the Benefits of Financial Statements?

Financial statements demonstrate a company’s operations. It gives information about a company’s assets, liabilities, operating expenses, cash flow management effectiveness, and how much and how a company earns revenue. A company’s management style is entirely revealed through its financial accounts.

Disadvantages of Business Financial Statements

There are drawbacks to using financial statements to inform judgments about future planning, expansions, and product launches by senior executives, accountants, and financial planners.

Based on Market Patterns

The fact that the data and figures in financial statements are reliant on the market at the moment presents one drawback of using them for decision-making.

Executives shouldn’t expect that the figures from a previous financial statement will stay the same or go up because the market could shift suddenly.

Simply because a business sold 5 million copies of a product in a single year does not mean it will continue to sell as many or more. If a rival launches a comparable product, it can sell much less.

At-One-Time Analysis

Another drawback is that a single financial statement only provides information about a company’s performance at a single point in time.

For instance, the company’s performance is not shown in the financial statement if it is better or worse than it was the previous year.

In order to have a comprehensive view of how the business is doing, executives should study numerous financial statements from earlier months and years if they chose to use financial statements to make judgments about the future.

Instead of having a single statement, the financial statement becomes a continuous examination, which is more beneficial.

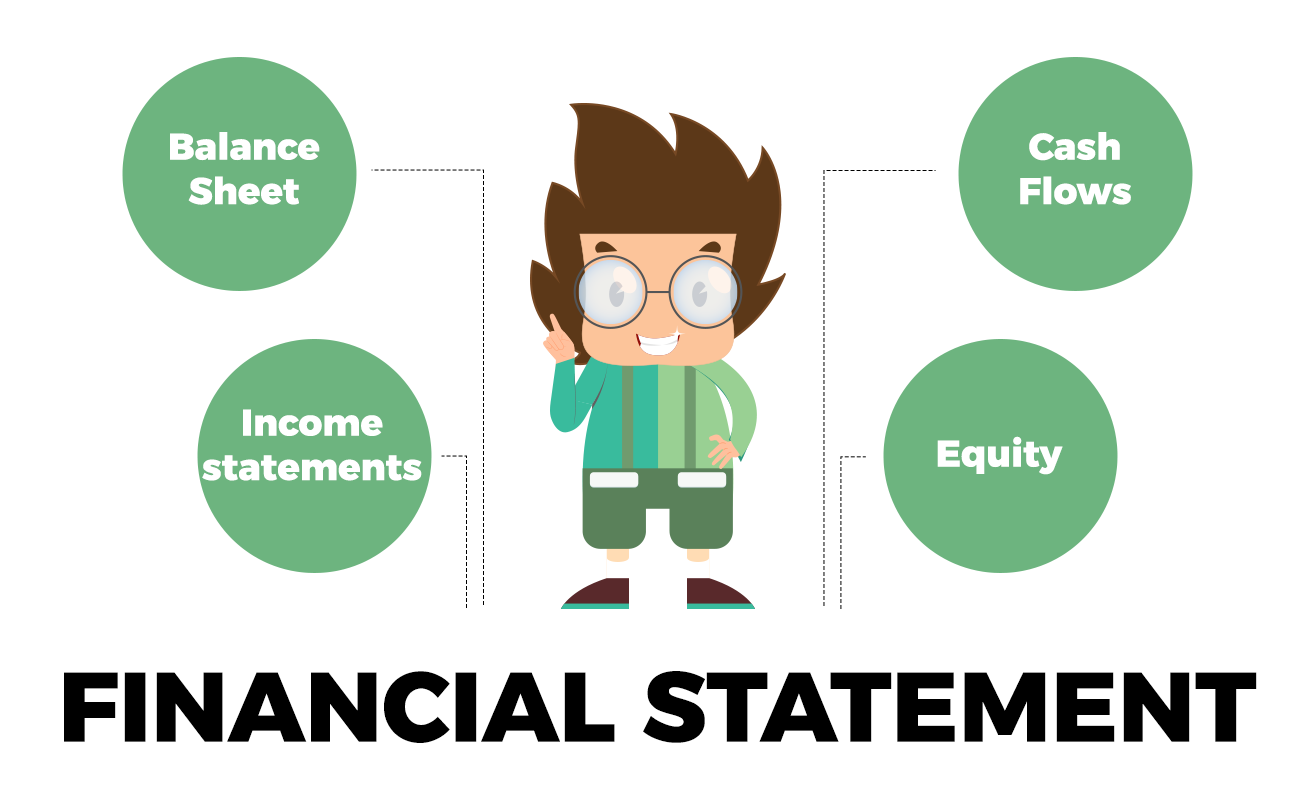

4 Types of Financial Statements

Important financial ratios are computed using information from the balance sheet, the income statement, and the cash flow statement.

These ratios offer insight into the company’s financial performance and possible problems that may need to be resolved.

The balance sheet, income statement, and cash flow statement all provide distinct facts with associated data. The three statements are taken as a whole offer a complete picture of the company’s operational activity.

Balance Sheet

A company’s assets, liabilities, and shareholders’ equity are outlined in the balance sheet as a snapshot in time. You may find out when the snapshot was taken by looking at the date at the top of the balance sheet, which is often the conclusion of the reporting period. A list of the components of a balance sheet is shown below.

Assets

- Liquid assets include cash and cash equivalents, such as Treasury bills and certificates of deposit.

- The sum of money owing to the business by its clients for the sale of its goods and services is known as accounts receivable.

- Inventory is the stock of items that a corporation has on hand and plans to sell regularly. Finished goods, unfinished work in progress, and unprocessed raw materials may all be included in an inventory.

- Costs that have been paid in advance of their due dates are referred to as prepaid costs.

These costs are recorded as an asset since their worth has not yet been appreciated; should this happen, the business would theoretically be entitled to a return.

- A firm owns the property, plant, and equipment as capital assets for long-term gain.

This includes structures that are utilized for production and large equipment that is used to process raw materials.

- Assets retained for potential future growth are called investments. These are merely held for capital appreciation and are not employed in operations.

- Although they cannot be physically touched, goodwill, patents, trademarks, and other intangible assets have potential economic (and frequently long-term) benefits for the business.

Liabilities

- The bills that are due as part of a business’s regular operations are known as accounts payable. Utility bills, rent statements, and commitments to purchase raw materials all fall under this category.

- Wages payable are sums owed to employees for hours performed. Official debt arrangements, including the payment schedule and amount, are documented in notes payable, which are recorded debt instruments.

- Dividends declared to be paid to shareholders but not yet received are referred to as dividends payable. Mortgages, sinking bond funds, and other loans with longer-than-one-year full payment due dates can all be considered long-term debt. Keep in mind that this debt’s short-term part is listed as a current liability.

Shareholders’ Equity

- A company’s entire assets less its total liabilities equals its shareholders’ equity. Shareholders’ equity, also called stockholders’ equity, is the sum of money that would be given back to shareholders if all of the company’s assets were sold and all of its debts were settled.

- The number of net earnings that were not distributed to shareholders as dividends are known as retained earnings and are a component of shareholders’ equity.

How is a balance sheet connected to an income statement?

When double-entry accounting is employed, there is a link between the balance sheet and the income statement. In other words, rising revenues and gains as shown on the income statement led to rising stockholders’ equity on the balance sheet.

Stockholders’ equity also decreases on the income statement as a result of increases in expenses and losses that are recorded there. Additionally, the income statement shows a loss when an asset is written down on the balance sheet.

Income Statement

The income statement, which is a year for yearly financial statements and a quarter for quarterly financial statements, spans a period of time, unlike the balance sheet. An overview of revenues, costs, net income, and earnings per share is given in the income statement.

Revenue

Selling goods or services generate operating revenue for a business. The production and sale of automobiles would generate operating revenue for an auto manufacturer. Operating revenue is produced by a company’s main lines of business.

The income derived from non-core company operations is known as non-operating revenue. These revenues are unrelated to the company’s main purpose. Examples of non-operating revenue include:

- Interest accrued on bank balances

- income from a property’s rentals

- income from strategic alliances, such as receipts for royalties

- income from a display of advertisements on the company’s premises

The money made from other endeavors is known as other income. Gains from the sale of long-term assets like property, cars, or a subsidiary could also count as additional income.

Expenses

When a business engages in its main activity, it incurs major expenses in order to generate revenue from that activity. Cost of goods sold (COGS), selling, general and administrative (SG&A), depreciation or amortization, and research and development are examples of expenses (R&D).

Employee salaries, sales commissions, utilities like electricity, and travel costs are examples of typical costs. Interest on loans or debt is a cost associated with the secondary activity. Expenses are also documented for losses on asset sales.

How does a multi-step income statement differ?

A multi-step income statement uses a three-step process to determine net income, distinguishing operational from non-operational revenues and expenses. A single-step income statement provides a straightforward accounting of a company’s net income.

Operating Income Vs. Non-Operating Income

Whatever name it goes by, the operating figure that is recurring in nature is what the analyst is searching for. The analyst must therefore base his evaluation of income and costs solely on this criterion.

Operational income refers to all activities carried out by a firm in the normal course of operations, as well as any auxiliary activities or activities that flow naturally from or result from these activities.

Non-Operating Income and expenses originating from occurrences or transactions that are obviously different from the business’ usual operations and are not anticipated to happen frequently or regularly, such as asset expropriation or natural disasters like earthquakes.

Cash Flow Statement

The Cash Flow Statement (CFS) gauges how effectively a business earns cash to cover debt payments, operating costs, and investments. The balance sheet and income statement are enhanced by the cash flow statement.

Investors may learn how a firm operates, where its funding comes from, and how it spends money thanks to the CFS. The CFS offers information about a company’s financial stability as well.

A cash flow statement cannot be calculated using a specific formula. Instead, it has three sections that detail the cash flow for the many purposes for that a business uses its funds. The following is a list of the three CFS components.

Operating Activities

Any sources and expenditures of money resulting from managing the company and making sales of its goods or services are included in the operating activities of the CFS.

Any adjustments to cash accounts receivable, depreciation, inventory, and accounts payable are included in cash from operations.

Wages, tax payments on income, interest payments, rent payments, and cash earnings from the sale of goods or services are also included in this list of transactions.

Investing Activities

Any sources and uses of money from a company’s investments in the long run of the company are considered investing activities. This group includes any payments connected to a merger or acquisition as well as the acquisition or sale of an asset, loans given to or received from suppliers, and customer loans.

Additionally, this part includes purchases of permanent assets like property, plant, and equipment (PPE). In other words, changes to investments, equipment, or assets are related to cash from investments.

Financing Activities

Funds used for financing comprise payments made to shareholders as well as cash obtained from banks or investors. Loans, dividend payments, stock repurchases, equity issuances, debt repayments, and loans are all examples of financing activities.

In three key company activities, the cash flow statement reconciles the balance sheet and the income statement.

Financial Statements Examples

Example of a Balance Sheet

A portion of the ExxonMobil Corporation (XOM) balance sheet for the fiscal year 2021, as of December 31, 2021, is shown below.

- There were $338.9 billion in total assets.

- Liabilities as a whole were $163.2 billion.

- Equity as a whole was $175.7 billion.

- The entire liabilities and equity for the time came to $338.9 billion, matching the total assets.

Example of an Income Statement

The income statement for ExxonMobil Corporation’s fiscal year 2021, as of December 31, is excerpted below.

- $276.7 billion was earned in total.

- The entire cost came to $254.4 billion.

- There was $23 billion in profit or net income.

Example of a Cash Flow Statement

The cash flow statement for ExxonMobil Corporation‘s fiscal year 2021, as of December 31, is shown in part below. The three components of the cash flow statement are visible, as are their outcomes.

- 48 billion dollars of positive cash flow were produced by operating activities

- For the time period, investing activities resulted in negative cash flow, or cash outflows, of -$10.2 billion. The majority of cash outflows were for purchases of new property, plant, and equipment, indicating that the corporation made new fixed asset investments.

- For the period, financing activities resulted in negative cash flow, or cash outflows, of $35.4 billion. The majority of the cash withdrawals were due to dividends paid and reductions in short-term debt.

Nonprofit Financial Statements

Financial transactions are reported by non-profit organizations using a comparable set of business financial statements. However, there are variances in the business financial statements utilized between a for-profit organization and a wholly charitable entity due to these disparities. The typical set of financial statements utilized by a charitable organization consists of:

Statement of Financial Position

This is comparable to a balance statement for a for-profit organization. The biggest distinction is that nonprofit organizations do not own equity interests; any remaining sums after all assets have been sold off and liabilities have been paid in full are referred to as “net assets”.

Statement of Activities

This is comparable to a statement of income for a for-profit organization. This report monitors the evolution of the business through time, as well as donations, grants, event income, and costs incurred to make things happen.

Statement of Functional Expenses

This is unique to non-profit organizations. By entity function, expenses are reported in the statement of functional expenses (often broken into administrative, program, or fundraising expenses).

The public is given access to this information to better understand what percentage of corporate costs are directly attributable to the mission.

Statement of Cash Flow

This is comparable to a cash flow statement for a for-profit organization. The statement is still broken down into operating, investing, and financing operations even though the accounts presented may differ according to a nonprofit organization’s unique characteristics.

Conclusion

The key to an outside assessment of a company’s financial performance is its financial statements. While the income statement provides information on a firm’s profitability, the balance sheet provides information on the liquidity and solvency of the organization.

By keeping track of the sources and uses of money, a statement of cash flow links these two together. Financial statements are taken as a whole show how a business is doing over time and in comparison, to its rivals.

Recent Comments