Cash & Cash Equivalents (CCE)

Finance

LAST UPDATE: NOV 13, 2022

8 minutes reading

Cash is the biggest line item on a balance sheet for every business, although cash equivalents are also included. Cash and Cash equivalent include things like Treasury bills, cash in checking and savings accounts, marketable securities, commercial paper, government bonds with a maturity date of 3 months or less, money market accounts, and regular old dollar notes and coins. These are thought to be able to fast convert to cash.

To calculate the minimal amount of cash required and to assess the company’s liquidity, information on the movement and availability of funds is required. The first items we see on a company’s balance sheet are cash and cash equivalent, which are the easiest-to-access portion of a company’s current assets.

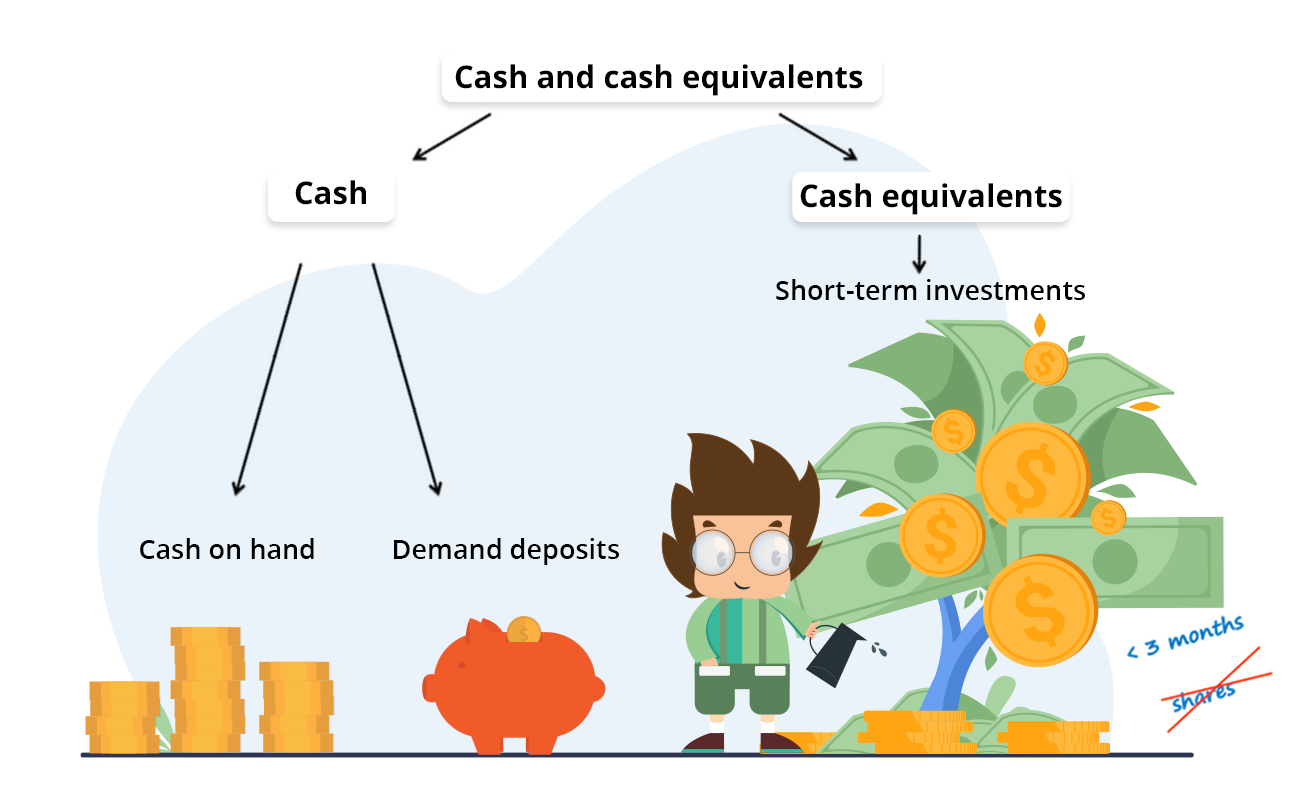

What are Cash and Cash Equivalents?

The line item on the balance sheet that shows the value of a company’s assets that are cash or can be instantly turned into cash is referred to as “cash and cash equivalents.” Bank accounts and marketable securities, or debt securities with maturities of fewer than 90 days, are examples of cash equivalents. However, because equity and stock assets can fluctuate in value, cash equivalents frequently do not include them.

When a business has extra cash on hand, it may invest it to earn interest in low-risk liquid (easily sold) securities. As a result, particularly liquid securities are occasionally referred to as Cash and Cash equivalents.

List of Cash & Cash Equivalents

- Securities with a maturity of less than or equal to 90 days are known as cash equivalents.

- Stocks (Equity Investments) are not included in this list because of the daily price fluctuations and high risk associated with stocks.

- Within three months of the redemption date, preferred stocks may be included.

What Distinguishes Investments from Cash Equivalent?

- The term Cash Equivalents can vary from that of Short-Term Investments. Unlike short-term investments, which mature within a year, cash equivalents have a maturity of fewer than three months.

- Long-term investments are not categorized as Cash Equivalents because they have a maturity of more than 12 months.

What is the Nature of Cash Equivalents?

1. Convertible To Cash

Cash equivalents are designed to satisfy a business’s immediate needs. The retention of cash equivalents is not done for long-term planning or investment.

2. Convertible To Known Amount

Simply put, a monetary equivalent need not be redeemable for cash. It must be converted into a fixed sum. This means that the market price should either be predetermined or susceptible to significant volatility.

3. Low Risk

Since cash equivalents are short-term in nature and shouldn’t experience large changes, the instruments should have minimal to negligible risk and be easily converted to cash. As a result, the majority of assets that are considered cash equivalents have a maturity of fewer than three months.

4. Not Equity Investments

In general, equity investments are excluded from the category of cash equivalents, except preference shares, which can be redeemed on a specific date and are purchased soon after reaching maturity.

On the asset side of a company’s balance sheet, cash & cash equivalents are listed.

Types of Cash and Cash Equivalent

Since these liquid assets are utilized to settle current liabilities, which are short-term loans and bills, cash & cash equivalents assist businesses with their working capital requirements.

Cash

Money that is in the form of currency, such as coins, bills, and currency notes, is referred to as cash. An account type known as a demand deposit allows money to be withdrawn at any moment without informing the institution.

Checking and savings accounts are two instances of demand deposit accounts. Cash totals contain the balances of all demand accounts as of the date of the financial statements.

Foreign Currency

Companies that hold multiple currencies may be subject to currency exchange risk. For financial reporting, foreign currencies must be converted into the reporting currency. The conversion should produce outcomes that are similar to what would have happened if the company had run its activities in only one currency.

Cash & Cash Equivalents do not include translation losses due to currency devaluations. These losses are included in the “accumulated other comprehensive income” financial reporting account.

Cash Equivalent

Investments that are easily convertible into cash are known as cash equivalents. The investment must be made for a brief period, typically 3 months or less. An investment should be recorded in the account labeled other investment if it matures in more than 3 months. Cash equivalents have to be very liquid and simple to sell. These investors’ buyers ought to be simple to reach.

Visit our website to learn more about inventory management.

Examples of cash equivalents include:

§ Marketable Securities

Any investment security that can be promptly turned into cash in a short amount of time falls under this general phrase. The examples below include a lot of marketable securities, which businesses frequently group on their balance sheet.

§ Treasury Bills

These debt instruments are issued by the US government and frequently have a one-year or shorter maturity term.

§ Other Short-Term Government Bonds

Any government agency may issue these debt instruments (city, state, or Federal). When assessing the bond’s risk, the government agency’s creditworthiness must be taken into account.

§ Banker’s Acceptance

A future contract between two parties is guaranteed by the bank under this agreement. This instrument consists of a predetermined sum that will be paid to the bearer on a particular day.

§ Commercial Paper

These are corporate short-term bonds or debt obligations. Commercial paper has a nine-month maturity (270 days). The creditworthiness of the issuing company will influence the interest rate on commercial paper.

§ Money Market Account

This interest-bearing account resembles a savings account in several ways, but it frequently has higher minimum deposits and a few minor account restrictions.

§ Certificates of Deposits

Depending on the maturity date, CDs might qualify as cash equivalents.

§ Preferred Shares of Equity

If the securities are bought just before the redemption date and their value is not anticipated to change much, they may be regarded as cash equivalents.

Cash Equivalents vs Cash: What Is the Difference?

Direct possession of money issued by the government is known as cash. This could come in the form of actual money (coins and bills) or virtual money (i.e., bank account balances).

Cash equivalents are short-term investments with limited loss potential, easy liquidity, and active markets for speedy settlement. These instruments are easily convertible to cash, but they are not real claims to cash’s ownership, hence they are given a distinct classification.

Are Cash Equivalents Better Than Cash?

For some investors, cash equivalents are preferable to cash due to several advantages. Both classes of financial assets, however, are quite comparable and have low yields. There is not much of a distinction between Cash & Cash Equivalents

Why Do Businesses Hold Cash Equivalents?

The yields on cash equivalents are frequently marginally higher. Even purchasing one-month Treasury bills could result in yields that are higher than what a business might receive in its savings account. A corporation can hold low-risk investments strategically while trying to preserve purchasing power more effectively using cash yields than with direct cash holdings.

Not Included in Cash & Cash Equivalents

There are some instances where short-term and current assets do not fall within the category of Cash & Cash Equivalents

1. Credit Collateral

If short-term debt instruments like Treasury bills are being used as collateral for an active loan or line of credit, there may be an exception. T-bills with restrictions must be submitted separately. In other words, the ability to convert any of the securities designated as Cash & Cash Equivalents cannot be restricted.

2. Inventory

Because it could be difficult to convert stock that a business keeps on hand into cash, it is not regarded as a cash equivalent. Additionally, the value of inventory is not guaranteed, therefore it is uncertain how much will be received when it is liquidated

3. Guaranteed Certificates of Deposit

Certificates of Deposit with periods longer than three months that cannot be broken fall under the category of cash equivalents.

Financial firms frequently agree to waive interest in exchange for letting the owner of a CD break their financial product (i.e., the last six months of interest is foregone).

The CD shouldn’t be regarded as a cash equivalent if a financial institution forbids this choice. This is especially true for longer-term products that must be held until maturity, such as five-year CDs.

4. Reserved Assets

Prepaid assets may be included in a company’s current asset section. These paid-for resources might be returnable. Prepaid assets are not regarded as cash equivalents, however, due to the possibility that a refund may not be executed promptly or that there may only be a partial return of funds.

5. Receivables Accounts

Even if the invoice is passed late or is about to become due, unpaid account receivable balances are not cash equivalents due to the uncertainty surrounding the creditworthiness of the clients. There is no assurance the client will be able to pay, even if the debt is prepared for collection.

Additionally, the business might not be given preference in bankruptcy or liquidation proceedings. Client debt is therefore not the same as cash equivalents.

The Bottom Line

The most liquid current assets on a company’s balance sheet are Cash & Cash Equivalents. The remainder of this categorization is made up of a variety of financial products, most of which have maturities of three months or less, are readily convertible to cash, and are not subject to any restrictions that might impede their liquidity.

Companies frequently keep cash and cash equivalents on hand to cover short-term debt and store funds for future usage in safe locations.

Recent Comments