All You Need to Know About Financial Modeling

Finance

LAST UPDATE: NOV 12, 2022

9 minutes reading

One of the talents in financial analysis that is most highly regarded yet poorly understood is Financial Modeling. A forecast of a company’s future performance is the global financial Modeling, which combines accounting, finance, and business measurements.

What Is a Financial Modeling?

A financial model is just a spreadsheet, typically created in Microsoft Excel, that projects the future financial performance of a company.

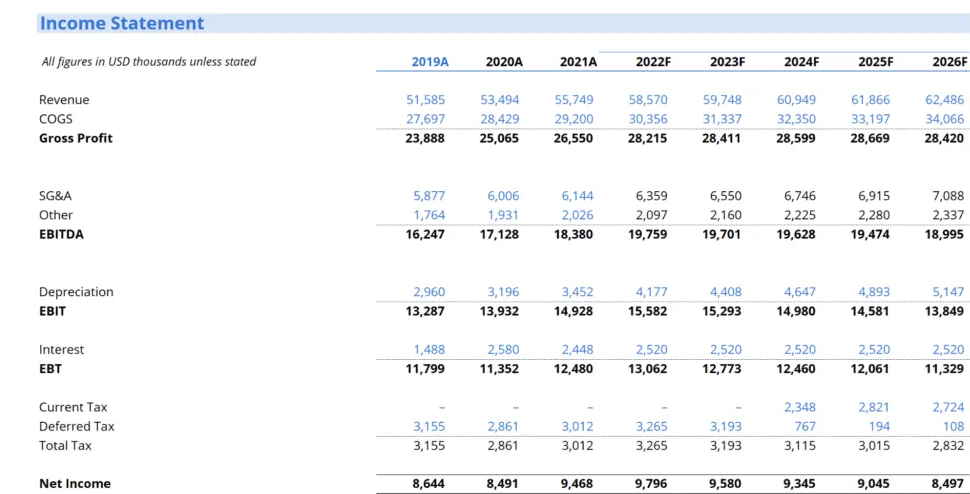

The projection requires the preparation of an income statement, balance sheet, cash flow statement, and supporting schedules and is often based on the company’s historical performance and predictions (Known as a 3-statement model).

From there, more complex models can be created, including sensitivity analysis, leveraged buyouts, mergers, and acquisitions, and discounted cash flow models. An excel financial modeling example is provided below.

What Is a Financial Model Used For?

Financial models come in a variety of forms with a variety of applications. Whether internal or external to the organization, decision-making and financial analysis employ the results of a financial model.

Using financial models, choices are made regarding:

- Raising Money (Via Loan or Equity)

- Making Purchases of Businesses or Assets

- Increasing The Company Organically (E.G., Opening New Stores, Entering New Markets, Etc.)

- Selling Or Letting Go of Company Units and Assets

- Forecasting And Planning (Planning for The Years Ahead)

- Investment Allocation (Priority of Which Projects to Invest In)

- Valuing A Business

- Analysis Of Financial Statements and Ratio Analysis

- Management Accounting

Also, you can read more about (What Is Business Financial Statements)

Is Financial Modelling Easy?

Building a simple financial model in Excel is rather simple, and it helps develop excel abilities, formula logic, and conventions you’ll need to build more intricate models later. Additionally, you can experiment with your assumptions to see how they impact the result.

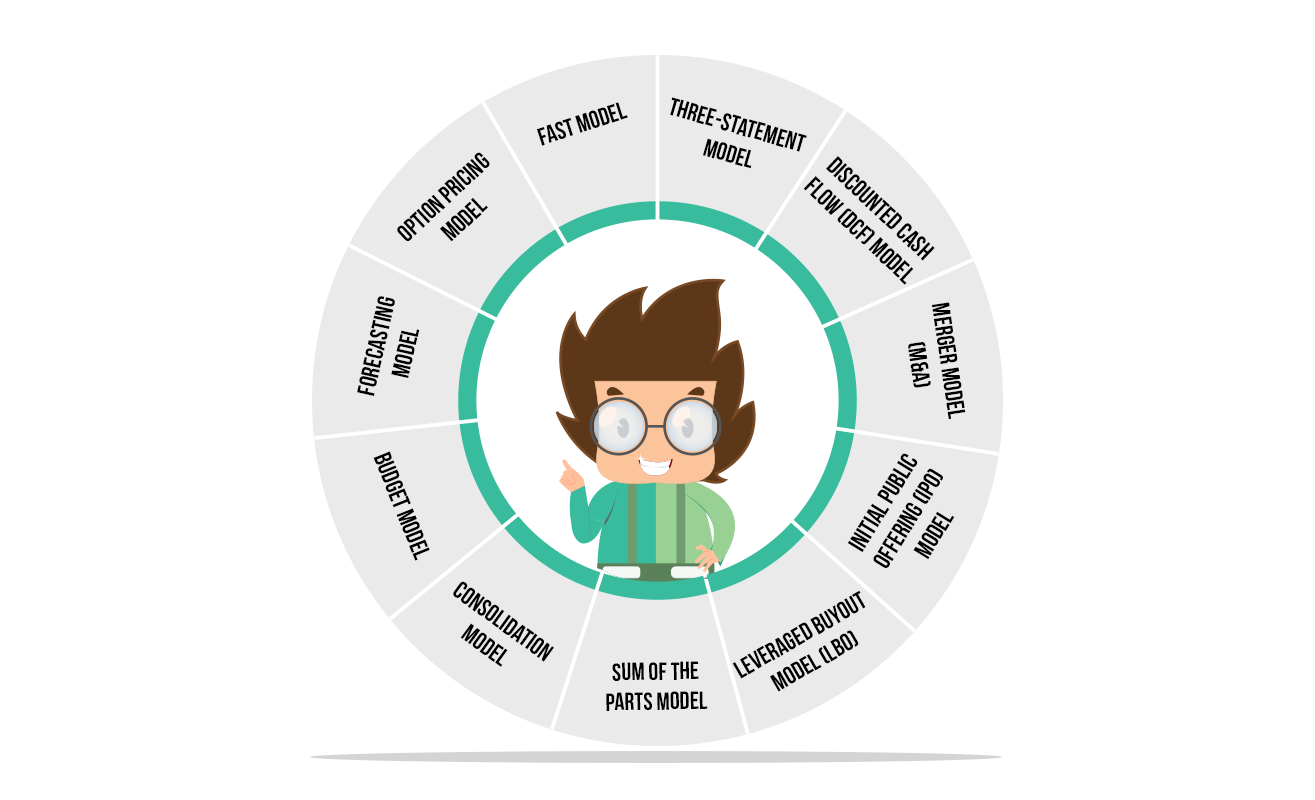

What Are the Types of Financial Models?

Here is a list of the 10 most common types of financial models:

- Three-Statement Model

- Discounted Cash Flow (DCF) Model

- Merger Model (M&A)

- Initial Public Offering (IPO) Model

- Leveraged Buyout (LBO) Model

- Sum of the Parts Model

- Consolidation Model

- Budget Model

- Forecasting Model

- Option Pricing Model

- Fast Model

Determining the model’s ideal structure requires understanding its goal. Granularity and flexibility are the 2 main factors determining a model’s appropriate structure.

Let’s consider the following 5 common financial models:

| Model | Purpose | Granularity | Flexibility |

|

One-page DCF

|

used to establish a valuation range for one of several potential acquisition targets in a buy-side pitch book. |

Low. A rough estimate is adequate Small. All of the analyses will fit on a single worksheet (300 rows).

|

Low. unable to be reused without structural changes. will be distributed only to 1-3 deal team members and used in a specific pitch. |

|

Fully integrated DCF

|

used to value the target company in a fairness assessment given to the board of directors of the acquiring company

|

Medium |

Low. unable to be reused without structural changes. will be distributed across deal time participants and customized for use in the fairness opinion.

|

|

Comps model template

|

All of the industrial team members at a bulge bracket bank use it as the standard model. |

Medium |

High. without requiring structural changes to be reused. a sample that will be applied to many analysts, associates, and perhaps other stakeholders’ proposals and deals. will be used by Excel users of various ability levels.

|

|

Restructuring model

|

Built specifically for a multinational corporation to stress test the impact of selling 1 or more businesses as part of a restructuring advisory engagement

|

High |

Medium. Some degree of reuse, but not quite a template Will be used by the deal team and associates at the client company. |

|

Leveraged finance model

|

used to evaluate loan performance under various operating scenarios and credit events throughout the loan approval process |

High |

High. without requiring structural changes to be reused. a model that the entire group can use. |

Financial Model Granularity

Granularity is a crucial factor in determining the structure of the model. How specific a model needs to be is referred to as its granularity. Consider the scenario where Disney asks you to conduct an LBO analysis using consolidated data and extremely basic finance assumptions that may be adequate for the goal to generate a back-of-the-envelope floor valuation range to be included in a preliminary pitch book.

Financial model Flexibility

The required flexibility of a financial model is the other key factor that determines how it should be set up. A model’s adaptability depends on how frequently. It will be used by how many people, and for how many various purposes. A model created for a specific transaction or organization has much fewer flexibility requirements than one created for frequent reuse (often called a template).

What Are Some Examples of Financial Models?

Imagine that the eccentrically wealthy uncle phones you to inform you about his most recent investment, a $100,000 pour into a tequila company.

He provides information on the company’s market share, sales, and personnel count before claiming that his $100,000 investment will be worth $1 million in 5 years.

Then he gently exhorts you to invest your entire life savings in his tequila business. You can enter these variables, forecast the company’s future cash flows, and evaluate the possibility that your uncle’s $100,000 investment will increase to $1 million in five years using a rigorous financial model.

Any outcome cannot be predicted using financial models with a high degree of certainty.

But instead of being “exactly wrong,” the objective is to be “approximately correct”

If a financial model tells you that a company is undervalued by 5% or 10%, that is a useless result because the margin of error is so high.

But if the model tells you that the company is undervalued by 90% or overvalued by 200%, those are much more useful results.

You can still profit if you are right about the direction but wrong about the percentages.

Going back to the example of the tequila company, let’s say that your model yields the following outcomes for your uncle’s $100,000 investment:

- $1 million in 5 Years: To achieve this goal, the tequila company would need to increase its market share from 1% to 10% in just 5 years in a highly competitive sector. The corporation might potentially reach its goal by charging three times as much for its tequila and gaining 3% of the market.

- $500,000 in 5 Years: To achieve this, the business would need to either get 5% of the market within 5 years or sell its tequila at double the going rate and take 2% of the market.

- $200,000 in 5 Years: To achieve this, either 3% of the market must be attained in 5 years, or tequila must be sold for twice the going rate and 1% of the market (the same as the current share).

A financial model is like a piece of evidence in a murder trial; it is only ONE PART OF the investment process.

A spreadsheet cannot solve the case or convince the jury as a whole, but it can help convince others that you are right.

Take a look at our past blogs about Finance

6 Best Practices for Financial Modeling

A Financial model is crucial to running a firm. The stress of creating one can be reduced by using a financial model template, but creating a model in Excel might be challenging. It takes time to set up your formulas and conditional requirements. Worried?

When Developing Your Financial Models, Adhere to These Six Best Practices:

1. Plan ahead

Before you start creating a financial model, consider the following:

- What financial problem are you trying to solve with the model?

- Who is going to use the model?

- What will be the model’s purpose?

- What are your process, input, and output numbers?

- How would you organize all the inputs while building the model?

A vision and a goal must guide the construction of a successful financial strategy. This assists with future budgeting and sensitivity analyses as well.

2. Logically Organize the Metrics in Your Model

These three fundamental components must be present in your model when you develop it:

- inputs or assumptions. These numbers serve as your basic building blocks. For instance, what sort of revenue do you anticipate during that time?

- What numbers are the outcomes? What is the projected business footing if you have X, Y, and Z?

3. Keep Your Model’s Metrics Straightforward.

Anyone who utilizes financial models will tell you that they determine whether a model “works” for them in less than 30 seconds. The financial model will get more favorable feedback the simpler it is. Utilize your value metrics.

To make your cash flow statement and financial model straightforward, take into account the following dos and don’ts.

Do:

- No more than 15 assumptions should be used.

- Formula lengths should not exceed half the width of the formula bar.

- Avoid overusing cell names.

Don’t:

- Utilize various formulas across rows.

- Use a variety of formatting standards

- Leave out the executive summary

4. Avoid Using Values in Place of Formulas.

Hard values are not universally understood. Although it could initially save you time, it ultimately portrays you as undisciplined and jeopardizes the integrity and openness of your financial model. It will seem as though you haven’t done any financial analysis. When employing values rather than formulas in your forecasting model, the following problems can arise:

- The lack of explicit assumptions can be confusing to model users.

- Your justification isn’t as obvious.

- If your data’s source is unclear to somebody like your CFO, they might not trust it.

5. Balance Sheets and Cash Flow Forecasting Estimations Must Be Integrated.

A key component of your model is your balance sheet, cash flow calculations, and other financial statements like your income statement. Although it could be tempting to omit certain documents to save time, you must never do so.

To effectively depict things like capital expenditures, value-based pricing, tier pricing, stock turnover, private equity, debt dates, and creditor dates, proper financial planning requires that these be a part of your overall business model. End users need evidence of the results of your models to trust them.

6. Verify Your Model One Again for Flaws.

Examine your financial model’s accuracy to ensure you’ve done your homework and everything is in order. Sanity-check your plan; if it doesn’t make sense on paper, it probably won’t in actuality.

What Are the Tools for Financial Modelling?

Financial modeling tools are the knowledge, abilities, or other elements that enable an analyst to assess the worth of a firm, a market sector, or a project.

#2 Excel Knowledge

#3 Knowledge of Finance

#4 Knowledge of Accounting

#5 Knowledge about Economy

#6 Mindset

#7 Presentation Skills

#8 Color Formatting Knowledge

#9 Decision-Making Skill Set

#10 Critical Thinking Skill

Conclusion

Although the word Financial Modeling is a general one that can signify different things to different people, it is typically used to refer to applications in either quantitative finance or accounting and corporate finance.

Recent Comments