4 Ways to Calculate Your Inventory For eCommerce

Inventory Management

LAST UPDATE: OCT 14, 2022

10 minutes reading

The monetary value assigned to the items in inventory at the end of an accounting period is known as inventory valuation. The inventory is valued based on the expenses incurred to get it and prepare it for sale. The biggest current business assets are inventories.

You can assess your Cost of Goods Sold (COGS) and, ultimately, your profitability, thanks to inventory valuation. First-in, First-out (FIFO), Last-in, First-out (LIFO), and Weighted Average Cost (WACC) are the most popular valuation techniques.

What Is the Periodic Inventory System

The periodic inventory system is a technique for valuing inventory for financial reporting needs that involves physically counting the inventory at predetermined times. With this accounting technique, the cost of goods sold (COGS) is calculated by taking an inventory at the beginning of a period, adding new inventory purchases throughout the period, and subtracting ending inventory.

The Importance of The Inventory Valuation

It may seem simple to account for your small business‘s inventory, but there are various ways to value it. Your cash flow, capacity to borrow money, ability to sell your business, and taxes may all be impacted by the method you choose. To efficiently manage your accounting processes for the benefit of your firm, you must consider the implications of inventory value.

Taxes

Your inventory expenditures may be written off when you submit your taxable income to the Internal Revenue Service. The cost, the lower cost, the market value, or the “other” are all options for listing.

The cost is what you spent on inventory Management. You can use that value if the market price has fallen to the point that the inventory is no longer worth what you paid for it. You would most likely employ the retail method for “other,” lowering the value of your inventory by the typical retail markup you apply to it. Each of these techniques can produce various results and have an impact on how much you can deduct from your income in taxes.

Business Sale

You must be paid for your current inventory if you decide to sell your business. Although you have additional inventory costs that you should be reimbursed for, you can use a straightforward inventory valuation approach that is the same as the one you use for your taxes.

For instance, the labor costs incurred to store and maintain that inventory are actual costs you have incurred. The purchaser may also pay you back for the resources and supplies you used to keep inventory.

Buying a business

You will need to pay the owner for whatever goods they currently have in the business if you choose to purchase them. The owner has a financial incentive to overvalue his stock; on the other hand, you have a financial incentive to undervalue the stock. You should have no issues as long as you and your partner can agree on the cost basis.

You just count all of the inventory and check the costs listed on the invoices as paid. Be cautious if you adopt the retail approach.

Let’s use an illustration. You shouldn’t anticipate paying $130,000 minus 30%, or $91,000, which is the usual markup if the entire retail value of the goods is $130,000.

The 30% only applies to wholesale prices, not to retail prices, in this scenario, the inventory had a markup of $100,000. The result of multiplying $100,000 by 30% is $130,000. Not $91,000, you would have to pay $100,000.

Cash Flow

The quantity of minimal safety stock you maintain depends on how you value inventory. If you adopt the cost basis and your objective is to maintain $100,000 worth of inventory on hand, your task will be simple.

Make sure you are appropriately marking up inventory based on what you paid for it if you utilize the retail basis. Don’t assume that the retail price reflects a reasonable markup.

Your mark-up % is no longer accurate if inventory costs have increased but you are still charging the previous price. Because more of your sales are going to pay for inventory, you are probably bringing in less money than you believe.

Collateral for Lenders

Stock can be used as security for a loan. A stock valuation will be requested by the lender.

Because the lender will presume you would have to sell merchandise at a discount in an emergency, you cannot obtain a loan based on the retail value of the inventory.

When demonstrating the worth of your inventory to lenders, use your cost basis and be prepared to borrow only a portion of that amount.

Types of Inventory Valuation Methods

The Value of a business inventory is shown on its balance sheet, but where does that value come from?

There are 4 primary methods for valuing eCommerce inventories:

- FIFO (First-In-First-Out)

- LIFO (Last-In-First-Out)

- Specific Identification

- Weighted Average Cost

To value your inventory for tax purposes, the Internal Revenue Service only lets you pick between FIFO, LIFO, and Specific Identification, even if other valuation techniques might be more appropriate in some situations. For instance, you might select the inventory valuation technique that displays the largest net income if you’re writing an annual report for shareholders.

Let’s examine each of the four inventory valuation techniques in more detail so you can determine which is most appropriate for your company.

1- First-In, First-Out (FIFO)

You can assume that the first inventory items you stock your company with will be the first inventory items you sell when using the First-in, First-out, or FIFO technique of calculating inventory value.

Here is an illustration of FIFO:

Custom-made facial coverings are offered for sale by Masks and More, Inc. They obtained:

- 200 masks in April at $2

- 200 masks in May at $3

- 100 masks in June at $4

They purchased 500 masks in total and sold 300 masks throughout the course of the year. What value would you include for inventory if you were creating the company’s balance sheet at the end of the year if you used FIFO?

This can be resolved as shown below. You sell the oldest stuff first under FIFO. 300 products out of the initial inventory the 200 you bought in April have been sold, along with the first 100 from May. 200 products remain in stock if 300 were sold.

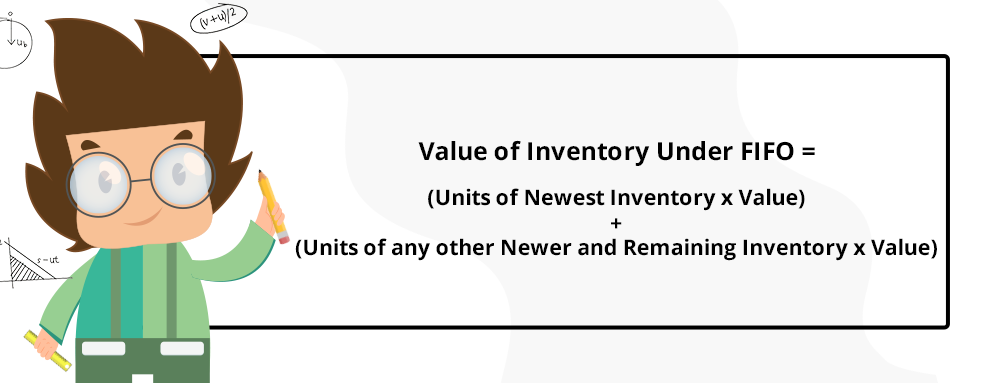

To value your inventory using FIFO for the company balance sheet, you multiply the 100 items that are left from your May purchase by the $3 you paid to purchase them. You add that to the 100 items left that you bought in June times the $4 you spent to purchase them.

Value of Inventory Under FIFO = (100 X $4) + (100 X $3) = $700

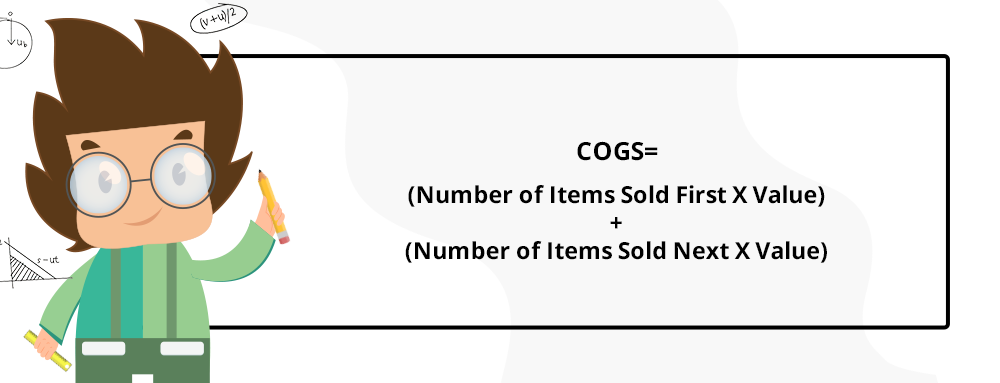

We can also calculate the cost of goods sold (COGS) if FIFO is the inventory accounting method. You sold 300 of the 500 units of inventory you had in stock.

COGS = (200 X $2) + (100 X $3) = $700

2- Last-in, First-Out (LIFO)

The newest things are sold first under Last-in, First-out, which is the opposite of FIFO. This can be resolved as shown below. Out of the 500 masks bought, 300 have been sold. So, the last item you purchased in May and June are sold.

200 items remain in stock if 300 were sold; the first 200 were bought in April for $2.

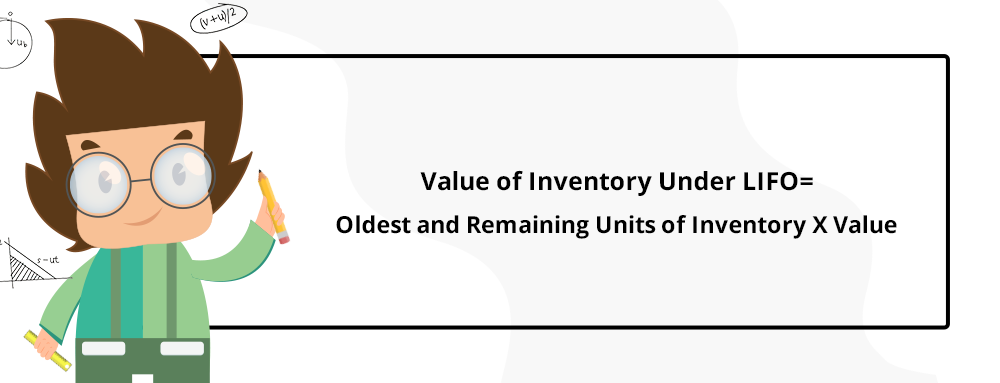

You multiply the 200 products that were initially purchased in April, which represent the oldest and remaining inventory, by the $2 purchase price to determine the cost of inventory in this case.

Value of Inventory Under LIFO = Oldest and Remaining Units of Inventory x Value

Value of Inventory Under LIFO = (200 X $2) = $400

Different inventory valuation techniques have a significant impact on the balance sheet of the company for the inventory line item because the value of the inventory is $700 under FIFO and $400 under LIFO.

If we calculate COGS with LIFO here, 300 units of inventory were sold, which were the last 300 masks purchased. Out of those, 200 were bought in May for $3 each. 100 were bought in June for $4 each. The formula is as follows:

COGS = (200 X $3) + (100 X $4) = $1000

As a result, you can see how various inventory valuation techniques provide various outcomes. In this instance, the profit margin is higher since COGS are much higher under LIFO than under FIFO.

3- Specific Identification Method

The particular identification method of inventory valuation is effective for organizations with a low inventory turnover ratio of high-cost commodities like vehicle dealers, furniture stores, and jewelry stores.

Each item in the inventory is given a unique identification number, along with the amount it was acquired for and any subsequent expenses. The entire cost of the company’s inventory is then calculated by adding up the value of all the stock still on hand.

The owner of the firm receives highly precise information on the value of their goods through specific identification.

4- Weighted Average Cost Method

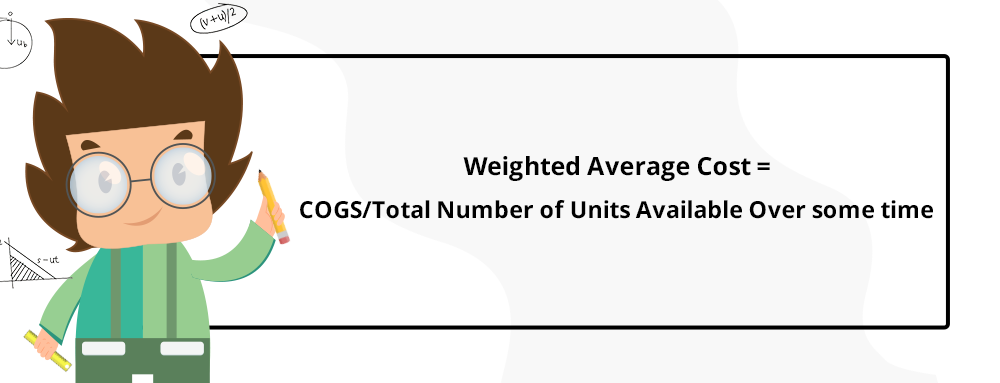

The Weighted Average Cost Method is used when organizations don’t have large changes in their inventory. It calculates the mean of all the units purchased during a certain period. The formula for weighted average cost is as follows:

Using our previous scenario (where we used the LIFO method), let’s imagine we have still sold 300 of the 500 masks. Our COGS then came to $1,000. Now we just divide that by our total units (500).

Weighted Average Cost = $1000/500 units = $2

So, our weighted average cost per unit is $

The Difference Between FIFO, LIFO, And the Weighted Average Cost

Businesses can choose from the three main accounting methodologies listed below when it comes time to account for their inventory:

- Average cost accounting by weight

- Using LIFO (last-in, first-out) accounting

- Accounting based on first-in, first-out (FIFO)

These three techniques each rely on a unique way to determine the item inventory and the cost of goods sold. Every one of these solutions can be suitable, depending on the circumstance.

Weighted Average vs. FIFO vs. LIFO Example

Think about the following scenario: Let’s say you operate a furniture store and you buy 200 chairs for $10 each. The following month, you spend $20 per chair on an additional 300 seats. Let’s imagine that you sold 100 chairs altogether at the end of a given accounting quarter. Following are the weighted average costs taking into account both FIFO and LIFO factors:

- 200 chairs at $10 per chair = $2,000. 300 chairs at $20 per chair = $6,000

- Total number of chairs = 500

Weighted Average Cost

- Cost of a chair: $8,000 divided by 500 = $16/chair

- Cost of Goods Sold: $16 x 100 = $1,600

- Remaining Inventory: $16 x 400 = $6,400

First In, First Out Cost

- Cost of goods sold: 100 chairs sold x $10 = $1,000

- Remaining Inventory: (100 chairs x $10) + (300 chairs x $20) = $7,000

Last In, First Out Cost

- Cost of goods sold: 100 chairs sold x $20 = $2,000

- Remaining Inventory: (200 chairs x $10) + (200 chairs x $20) = $6,000

Effective System That Helps You Lead Your Business

With New G solution, you can forget about the pain of inaccurate cost and profit calculations and always know the current worth of your inventory. To achieve the most precise profits, have the authority to set the costing strategy for each product:

- FIFO

- LIFO

- MAC

- Specific identification

Conclusion

As a business owner, you must evaluate each approach and use the one that best fits your unique business circumstances while accurately reflecting the periodic income. Both FIFO and LIFO accounting is permitted by the Financial Accounting Standards Board (FASB) in its Generally Accepted Accounting Procedures.

Recent Comments