Inventory Turnover Ratio, Explained With Examples

Sometimes a product may rush off the store quickly. It can be challenging to sufficiently discount at times. However, as most things move in a middling manner, all organizations must understand what is changing and how quickly.

The estimation of inventory turnover serves as the foundation for everything, from the business strategy and supplier relationships to marketing and the item lifecycle.

The turnover ratio also offers insightful data on a company’s forecasting, inventory management, and sales capabilities.

What Does the Inventory Turnover Ratio Mean?

Inventory turnover is a term that every business should be familiar with. It is a way to determine how often your inventory has been refilled and sold throughout a given period, or how frequently it has been turned over. Knowing your inventory turnover ratio will help you make key decisions about how to best use your company’s resources and how well it is performing overall.

Low turnover is indicated by poor sales, and a long inventory holding period, sometimes known as overstocking. It can indicate that there is a problem with the merchandise being offered or that there hasn’t been enough advertising.

A high ratio, on the other hand, indicates either excellent sales or insufficient stocks which may be related to inventory demand forecasting problems, the former is preferred, but the latter might lead to less business.

A low inventory turnover rate may be helpful when prices are anticipated to increase (and storage is prepared to accommodate the quickly growing demand).

Businesses often have greater success when their inventory turns over more quickly. The longer an item is kept, the more expensive it will be to maintain it and the less likely it is that customers would return to the store for more goods.

The quick fashion sector serves as a good illustration. At enterprises, used inventory is quickly replaced with new products.

Slower moving inventory has a higher inventory holding period compared to inventory that sells more quickly. The opportunity cost of low inventory turnover is the denying of the introduction of newer products that would sell faster because they take longer to sell.

How To Calculate It?

Knowing how to calculate inventory turnover ratio, which provides insight into how much inventory is sold over time, is essential in altering market movements.

To calculate the inventory turnover ratio, divide the cost of goods sold (COGS) by the average inventory for the same period.

An estimate of an item’s or group of items’ value or quantity over two or more defined periods is referred to as average inventory. Average inventory is the mean value of inventory during a given period, which may differ from the median value of the same data set. It is calculated by averaging the start and finish inventory values over that time.

At different times of the year, firms may have higher or lower inventory levels; usual inventory is taken into account in the ratio.

In the fourth quarter (Q4) before Christmas, for instance, stores would likely have more inventory, and in the first quarter (Q1) following Christmas, less inventory.

COGS is a metric can be used to determine a company’s manufacturing costs for goods and services. The expenses of raw materials, labor directly related to the products, and any fixed costs inextricably linked to production may all be included in COGS.

Inventory Turnover Formula

The basic inventory turnover ratio formula would therefore be applied as follows:

inventory turnover = cost of goods sold / average inventory value.

A healthy inventory turnover ratio is between 5 and 10, which suggests that you should sell and restock your product every one to two months. With this ratio, a good balance is struck between keeping enough stock on hand and avoiding unnecessary reorders.

Specialized organizations check up on the average inventory turnover ratio across a range of sectors. While such data are interesting to know, your business may not benefit from applying the average inventory turnover ratio for your sector.

Maximizing inventory control is one of the most crucial components of inventory turnover.

After learning how to calculate inventory turnover, we can put it to use in the following examples but it is important to learn more about how inventory turnover differs by industry, firm size, and other factors.

Examples of Inventory Turnover Formula

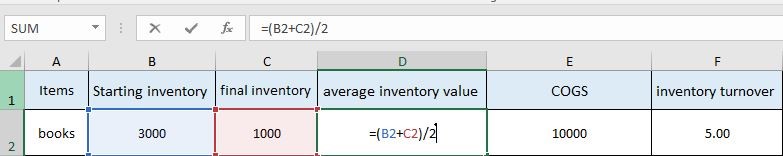

Inventory Turnover Example 1:

You are trying to determine the inventory turnover for your bookstore. The average inventory is $2,000 ($3,000 plus $1,000 divided by two) if your COGS are $10,000, your starting inventory is $3,000, and your final inventory is $1,000. These results are what we get when we enter those factors into the inventory turnover ratio formula:

inventory turnover = cost of goods sold / average inventory value.

$10,000 (your COGS) divided by $2,000 (average inventory value) equals 5 (your turnover rate)

In other words, over the year, you inverted your inventory 5 times for this item.

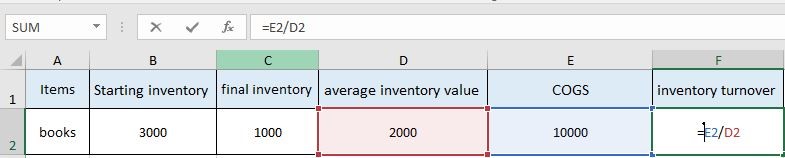

Inventory Turnover Example 2:

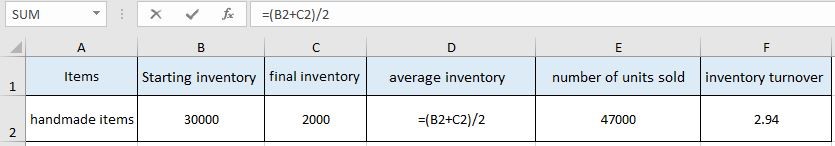

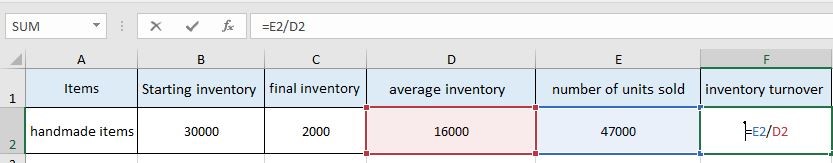

You can calculate your inventory turnover ratio in addition to the previous example by using units rather than expenses.

Imagine that you specialize in offering luxurious, handcrafted. the third quarter was the store’s best quarter, with 47,000 goods sold. estimates show that the average inventory is 16,000 items, therefore if we use the inventory turnover ratio formula for units and divide the starting inventory of 30,000 by the final inventory of 2,000, we obtain the following:

inventory turnover = sold items / average inventory value.

We divide 47,000 by 16,000 to get the inventory turnover ratio. E2/D2 is the inventory turnover.

Why Is the Inventory Turnover Ratio Important?

You may avoid being caught off guard by slow-moving merchandise by monitoring your inventory turnover ratio.

Instead of waiting until it is too late to respond, you can examine various parts of your business, consider the effects of digital marketing strategies, alter your price, and, if required, reassess your purchasing plan.

It is important to recognize that depending on the type of sold commodities, certain businesses may experience higher inventory turns than others.

You can do so in a variety of ways to increase performance.

For instance, if you sell high-end luxury goods like pricey accessories, you’ll be aware that their production cycles are longer, they take longer to sell, and they frequently result in lower annual sales.

In contrast, other things, like meals, are produced more quickly, sell a lot, and have shorter production times. Since there is typically greater demand for these items, there is a quick turnover

Utilizing the inventory turnover ratio, one may make strategic decisions about things like:

- advertising If your merchandise is scarcely moving and has a long inventory holding period, should you step up your promotional efforts?

To draw in more customers, and to be the center of attention.

- Buying goods: If your goods are selling too quickly, you might need to speed up your restocking orders.

Another option is to search for different sellers. If a product is doing well, you can choose to boost your inventory by stocking up on related products.

The Difference Between Inventory Turnover Ratio and Day in Sales Inventory

The following description of the word (DSI) Day in Sales Inventory can be used as an example: Day in Sales Inventory is a financial ratio that shows how many days it took a firm to sell its inventory during a specific year.

keep in mind that the organization’s and its inventory sales will fluctuate throughout the year. you must also take into account that this is a historical average.

The formula for days sales of inventory is the same as the formula for inventory turnover ratio with the following modifications:

(Average Inventory / COGS) x 365= Days Sales of Inventory.

Although there are a few significant differences, DSI and Inventory Turnover are sometimes mistaken.

The days sales of inventory formula and the inventory turnover ratio formula both give information on how long it takes to move goods, but they do it in different ways:

Days Sales of Inventory shows how long it normally takes to convert inventory into sales.

By examining your inventory turnover ratio, you can learn how frequently you completely replace your merchandise during a specific period typically a year.

Inventory turnover shows how well a company uses its inventory and generates sales, but DSI can give an in-depth insight into inventory control, the effectiveness of the stock-to-sale dateline, and how long, on average, a company’s cash is retained in inventory.

Conclusion:

We can emphasize the significance of using this standard and the indications it clarifies to evaluate the efficacy of your product because this is the business’s primary source of revenue, to compare a business with other businesses in the same industry, and to elevate your organization to higher levels of competition, financial efficiency, and optimal resource use based on the aforementioned definition of inventory turnover and other crucial related points.

Recent Comments