Weighted Average Method Definition and Examples

Inventory Management

LAST UPDATE: OCT 10, 2022

9 minutes reading

Are you a manufacturer? If the answer is yes, Inventory is the finished product you generate. Are you a retailer? if so, inventory is the merchandise you purchase to resell in your store. Small businesses that sell products need to have an inventory of that product on their shelves to stay in business. But how do you know the value of your inventory?

The First-In, First-Out (FIFO), Last-In, First-Out (LIFO), and Weighted Average Methods are the 3 primary methodologies for valuing inventories. We’ll get more into this, but let’s first cover some fundamentals.

What Are the Perpetual and Periodic Inventory System?

Periodic and perpetual inventory are two different forms of inventory, both accounting techniques that Businesses measure the number of products they have available. However, they are fundamentally different.

While a perpetual inventory system is automated by utilizing point-of-sale and enterprise asset management systems, a periodic inventory system entails a physical count at various points in time.

The former is more economical, while the latter requires more effort and expense to complete.

Periodic Inventory System

Smaller organizations that have easy-to-manage inventory and may not have the resources or opportunity to integrate computerized technologies into their workflow frequently use the periodic inventory system. Companies occasionally perform physical counts to gauge their inventory and the cost of goods sold (COGS).

A company’s gross margin is revealed by subtracting COGS from revenue, which is a crucial accounting metric. According to the periodic inventory system, the COGS is determined as follows:

Before weekly, monthly, or quarterly counts are performed at regular intervals, businesses may not always be aware of the inventory they have on hand. This is how the procedure goes:

- At The End of The Period, The Party Responsible for The Count Records All of The Available Inventory.

- Purchasing of Goods Is Documented in The Purchases Account.

- After The Count, This Is Transferred to The Inventory Account.

- The Start of the Current Period Is Then Adjusted to Reflect This New Balance, And the Procedure Is Repeated.

Important Note

The Cost of Goods Sold (COGS) includes elements like Direct Labor and Materials Costs and Direct Factory Overhead Costs

Perpetual Inventory System

The perpetual inventory system continuously monitors inventory balances. This is done by automated systems that track inventory purchases and sales utilizing enterprise asset management (EAM) and Point-Of-Sale (POS) technology. Compared to the periodic approach of inventory management, it is significantly more sophisticated.

The mechanism of perpetual inventory is rather intricate. As long as no things are stolen or damaged, inventory changes are accurate and easily accessible right away. As each sale is made, the COGS account is likewise regularly updated. Real-time transmission of the digitally gathered data to central databases.

It requires relatively little work from businesses because it involves the use of technology (if at all):

- Barcodes are assigned to products, which enable tracking of their movement and shelf life.

- The addition of computer software to the equation handles updating the inventory that enters and exits a business via the point-of-sale system.

- Information on purchases, COGS, and remaining stock is kept in separate ledgers.

Due to the expense of setting up and maintaining the infrastructure, this kind of inventory system can be highly expensive.

Comparatively speaking, the system is considerably simpler and easy to use. Not only does perpetual inventory provide real-time monitoring, but it is also significantly more accurate than physical counts.

Additionally, because every product has a barcode, businesses may learn more specifics about everything that enters and exits their warehouses.

What Is Inventory Valuation?

Companies use inventory valuation as a method of accounting to determine the worth of unsold inventory stock when generating their financial accounts. An organization’s inventory stock is an asset; to be included in the balance sheet, it must have a monetary worth. You can use this statistic to calculate your inventory turnover ratio, which will enable you to better plan your purchase actions.

Is Inventory an Asset?

There is a simple way to think about inventory to answer this question. An asset is something that your company possesses. Any debt that your company has to pay is a liability. An inventory is always an asset. Your inventory is yours. Although inventory might occasionally be a vulnerability, it is always also an asset.

For instance, if you own a shoe store and have 50 pairs of shoes left over at the end of the year, you must determine its financial worth and include it in your balance sheet.

What Is the Weighted Average Cost (WACC)?

The term “weighted average cost” in accounting refers to the method of determining expenses related to a company’s Cost of Goods Sold (COGS) and inventory.

Businesses frequently pay varying prices when ordering inventory since some stock kinds are not constantly available. Later on, this can be confused with individual pricing.

Businesses can better understand the overall costs related to inventories and COGS by using the weighted average cost method

The Importance of The Weighted Average Cost

Financial analysts generally agree on the significance and value of the weighted average cost of capital (WACC) as a tool for investors and businesses.

Businesses must consider both similar and different risks when making investment decisions and evaluating projects.

The WACC is necessary for the computation of significant metrics like net present values and economic value added. It is similarly crucial for investors who are valuing businesses.

WACC analysis can be viewed from the perspectives of the company and the investor.

From the company angle, it can be described as the combined cost of capital that the company must pay to utilize funds from both owners and debt holders.

From the investor angle, it is the opportunity cost of the investor’s capital, If the return offered by the company is less than its WACC, it is destroying value. As a result, investors may decide to stop funding the business and go elsewhere for a higher return.

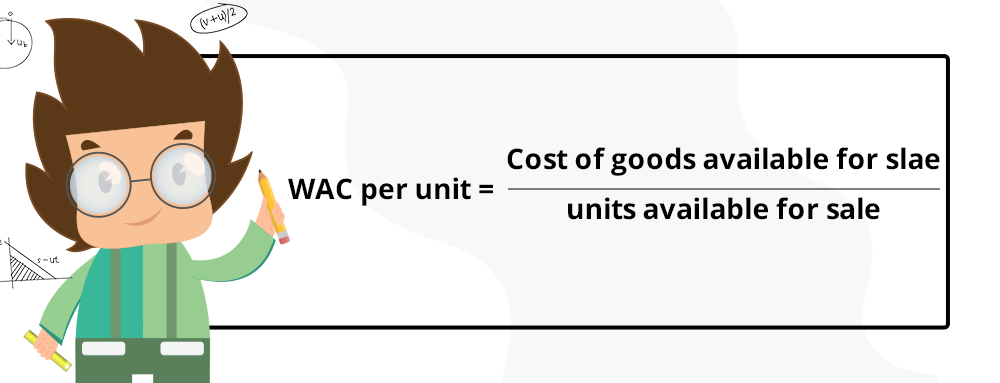

Weighted Average Method Formula

Example:

A manufacturer buys 20,000 units of a product at $1 each, 15,000 at $1.15 each and 5,000 at $2 each. We calculate the following using the units as the weight and the overall quantity of units as the total of all weights:

$1(20,000) + $1.15 (15,000) + $2 (5,000) / (20,000 + 15,000 + 5,000) =

($20,000 + $17,250 + $10,000) / ($20,000 + 15,000 + 5,000) =

$47,250 / 40,000 = $1.18

This results in a weighted average price per unit of $1.18.

Pros

- As A Benchmark for Within-Firm Comparison

The possibility that a company’s profits may fall short of what is required constitutes a business risk. You might be prevented from achieving the goals of your business by this danger.

Although it is typically the same within one industry, a business risk can differ from one to the next. A business with a lower WACC is in a better position in comparison to other businesses in the same sector. It can give its stakeholders more value.

- Used For Valuing a Firm

WACC is used by a valuation team to determine the firm’s value. Free Cash Flow to Firm (FCFF) is the money that is available to all debt and equity holders. The firm’s value is determined by analysts utilizing WACC, growth, and FCFF.

- Used as a Hurdle Rate

Finding the WACC is crucial because it is the lowest rate of return your business may achieve to satisfy its shareholders and creditors.

WACC acts as a barrier rate that businesses must clear to produce value for all owners and stakeholders.

- A Criterion to Accept or Reject a New Project

The weighted average cost of capital is used by the corporate finance team to determine whether to accept or reject a project.

The Internal Rate of Return (IRR) and the firm’s cost of capital are evaluated to determine whether to accept or reject a project.

Cons

- Calculating The Cost of Equity Is Challenging

The cost of debt and the cost of equity must be evaluated first before the WACC can be calculated. However, due to a lack of publicly available data, it is challenging to estimate the cost of equity for private companies.

The cost of equity calculation for publicly traded companies can be done in several different ways, so choosing one to employ requires careful consideration. The cost of equity cannot be calculated using a single formula. Calculating the WACC can also be challenging when determining the cost of equity.

- Unrealistic Assumptions

Both the WACC and the debt-to-equity ratio will change over time. The debt/equity ratio must remain constant, which is not conceivable, for WACC to be constant across the entire firm’s worth. The debt-to-equity ratio is taken into account while utilizing WACC.

- Increasing Debt to Achieve Lower WACC

Debt can be recorded on the balance sheet to lower WACC. To reduce the WACC, increasing the amount of debt above the ideal capital structure may result in a higher present value of the cost of financial distress than the value of the leveraged company.

When You Can Use the Weighted Average Method for Your Business?

If you regularly buy inventory stock, the weighted average strategy is effective. There is typically not much of a difference between average costing and the alternate LIFO pricing approaches when your inventory turns over quite quickly. Because you aren’t keeping track of every purchase or its associated price and volume, average costing is simple to handle even with a higher reorder frequency.

However, it is important to keep in mind that under the average costing approach, work-in-process data are merged with material prices and then averaged.

Confusion can result from this, which raises the possibility of human error and makes it challenging to efficiently track work-in-process for corporate records.

This method is frequently utilized When inventory products are so similar or blended together that it is impossible to assign particular costs to individual units.

A lot of industrial companies utilize weighted average costing since it can be challenging to distinguish between older and newer materials when inventory is frequently piled high or blended.

The Bottom Line

Inventory plays a significant role in the asset category of your balance sheet, so it is important for all business owners, whether they are seasoned pros or just starting out, to understand inventory valuation. You may achieve your business growth objectives and take advantage of the current market conditions by having a solid understanding of inventory valuation and its significance.

Recent Comments