Integrate with the Cheapest and Safest Payment Gateway in 2023

eCommerce

LAST UPDATE: AUG 2 , 2022

6 minutes reading

As technology opens up new digital landscapes, businesses nowadays have moved away from traditional payment methods, and new online methods of payment have appeared known as payment gateways.

Whether you have an online store or any website with visitors making online transactions, you would need payment gateways.

Payment gateways offer both brick-and-mortar and online sellers seamless and secure ways to pay, driving customers to safe and hassle-free buying.

What Is a Payment Gateway and What Does It Do?

A payment gateway is essentially an eCommerce service used to transfer payments between a customer’s credit or debit card provider and online businesses or brick-and-mortar stores.

eCommerce payment gateways use integration services to handle payment transactions to make payments for the customer orders.

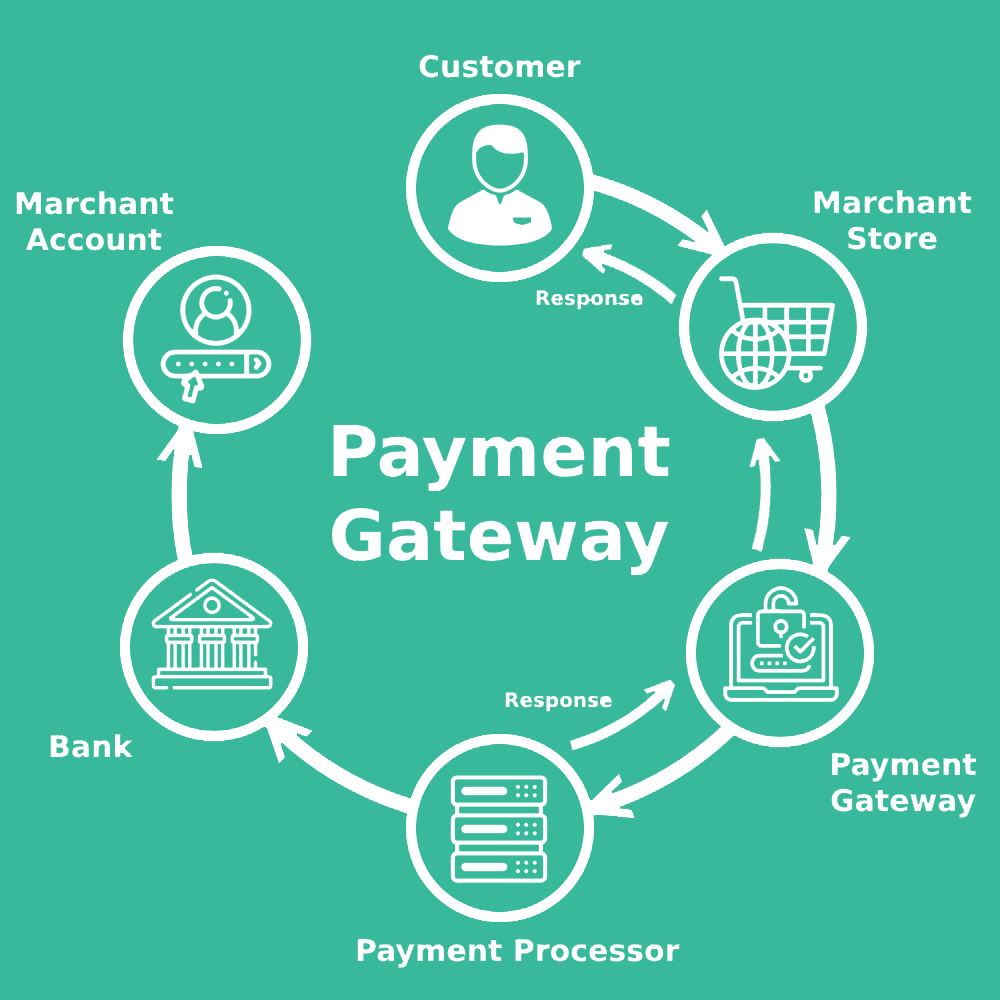

How Does It Work?

– The customer uses a credit card to complete a purchase on an ecommerce website, adding products he wants to the cart.

– The customer is asked to provide the details of the credit card or debit card to encrypt this data and pass it along to the payment gateway.

– The payment gateway uses secure connection to encrypt credit card data, which include card number, cardholder name, CVV number, and expiration, to send these details into the processing phase.

– The payment gateway forwards the credit card details to the payment processor of the merchant account bank, which in turn, contacts the credit card network of the customer (Visa, MasterCard, Maestro card, etc.).

– The card network routes the transaction information to the issuing bank (the customer’s bank).

– Here, there are two processes happen, the information is verified, and it is checked if there are enough funds to cover the payment transaction, after checking the security and ensuring that the transaction isn’t fraudulent, the issuing bank authorizes the transaction, and sends back an approval or decline message to the credit card network.

– The issuing bank will either approve or reject the transaction, if it is approved, the credit card network will inform the merchant account’s payment processor to release the funds from the issuing bank and hold them in the merchant account.

– The payment gateway passes the information to the ecommerce platform to either inform the customer the payment is successful with payment confirmation, or display other payment methods for customer to retry if there was an issue, or denied.

Types of payment gateway

According to the way of connecting, you can integrate payment gateways to your eCommerce store either internally or externally.

But how can you choose the best one for your business? what are the different types of payment gateways? what are the pros and cons?

Here are the different types of payment gateways:

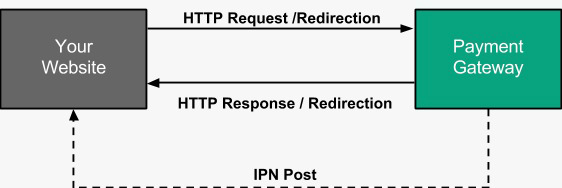

1- Hosted payment gateways

Hosted payment gateway will direct the customers away from your website’s checkout page, once the customer wants to make a purchase, he clicks on the “pay now” button at your website, then he will be redirected to the Payment Service Provider (PSP) page where the client needs to fill out payment details before redirecting back to your website to complete the checkout process.

The most popular example of a hosted payment gateway is PayPal.

Pros:

High level of security _ Transactions are Fully PCI compliant with a fraud protection system.

Simple common to most users, easy to install, user-friendly, and simple to use.

Customizable.

Cons:

Customer Experience – Cannot control the user end-to-end experience, because a hosted gateway is external.

2- Self-hosted payment gateways

In the self-hosted payment method, the payment details are collected from the customer inside the merchant’s website. After requesting the information, the collected data is then encrypted and submitted to the URL of the payment gateway.

Some gateways require a specific format for the payment data, whereas others need a hash key or secret key in order to protect the customer details while transferring from the eCommerce website to the payment gateway URL.

After the customer makes the payment. the eCommerce store debits the payment from the customer, then, a notification is sent to both eCommerce website owners and the customer.

Example: Authorize.net ARB.

Pros:

Customizable flow that provides a faster checkout process the merchant has full control over the payment journey of the user.

Great customer experience completing the whole transaction in one place.

Cons:

Full responsibility for security – Merchant has to take security measures to protect the user’s data.

No technical support team – you have to figure out the problem yourself or hire an outside professional which could be costly.

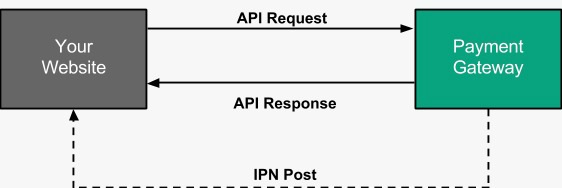

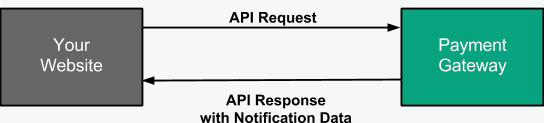

3- API hosted payment gateways

Also known as Non-hosted payment gateways, in this type of gateways, the customers enter their credit/debit card details directly on the merchant’s checkout page, the eCommerce website handles the checkout process, and controls the transaction of payments process using API (Application Programming Interface) or HTTPS queries.

After payment is made, a notification is sent to the customers. This type of gateway is suitable for all types of eCommerce platforms, due to the ability to be used with any device like mobile phones or tablets. and it can support recurring and fixed payments.

Example: Stripe.

Pros:

Customizable has full control over the UI of the payment journey and customer experience.

Capable of integration can be used with any device connected to the internet like mobile devices, laptops, tablets, etc.

Cons:

Security eCommerce platform is responsible for PCI DSS Compliance and purchasing SSL certification.

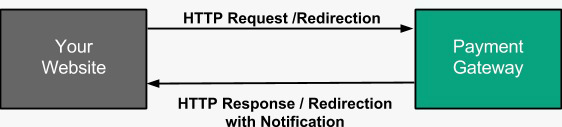

4- Local bank integration

When a client needs to buy a product, the local bank integration gateways redirect the client to the website of the payment gateway (the bank’s website) to fill in the payment details and contact information. Then, the client will be redirected back to the eCommerce platform website after making the payment, and a payment notification data is sent upon redirection.

In this type of payment gateway, Merchants need to do refund and cancellation processes manually with a continuous update process during the payment because it didn’t support them.

Example: Payseal.

Pros:

Quick and easy setup well suited for small businesses who need a simple one-time payment system.

Cons:

Basic features only it doesn’t enable returns or recurring payments. Therefore, it’s not suitable for wholesalers.

Payment Gateway vs Payment Processor

A payment gateway encrypts and securely transmits the payment data from the point of entry to the payment processor to continue the lifecycle of the transaction.

It also communicates the approval or decline of transaction to the merchant or the customer.

A payment processor is responsible for processing credit and debit card transactions between sellers and buyers.

The role of payment processor is to execute the transaction by transmitting the payment data among four parts, you as a merchant; the customer; the issuing bank (the customer’s bank), and the acquiring bank (your bank).

The difference between payment gateway and payment processor is that a payment gateway communicates the approval or decline of transactions between you and your customers, while a payment processor is responsible for settling the transactions, moving money to the merchant’s bank account from the issuing bank when the transaction is finalized.

Payment Gateway List

List of Top 10 Payment Gateways

1- PayPal

Best for Online Businesses.

2- amazon pay

3- skrill

4- stripe

Best Overall.

5- 2Checkout

Best for Selling Internationally.

6- Authorize.Net

7- Payza

8- SecurionPay

9- BlueSnap

10- Braintree

Best for Startups.

Payment Gateway Integration

Businesses always have ambition to grow, but the ability to scale in this case relies on your payment gateway provider.

Here are some eCommerce platforms that support payment gateway integration.

1- Shopify payment gateways

Shopify has its own payment gateway (Shopify Payments), and a full list of supported Shopify payment gateways.

2- Magento payment gateways

As Magento is an open-source eCommerce platform, you can integrate additional payment gateway services.

3- BigCommerce payment gateways

With more than 65 payment gateways integration, and supporting 250+ payment methods.

4- WooCommerce payment gateways

What to Consider When Choosing A Payment Gateway?

Selecting the best payment gateway for your eCommerce website is a crucial issue, every type of payment gateway has its own pros and cons, before you choose a payment gateway you need to think about your business model as well as the level of control over the payment experience of the customer.

Additionally, choosing a smooth, fast, and secure payment experience for customers will help you to develop better relationships with your customers and increase the trust in your eCommerce platform.

Here are four factors to consider when selecting the payment gateway:

Security

The payment gateway security standards should meet the PCI Data Security compliance and has customer fraud and hacking protection.

Easy Integration

The payment gateway integration should be simple and easy to use.

Payout Time

companies vary in the payout time frames (weekly or bi-weekly), choose the best one before integration.

Multi-Currency

People use different currencies around the world, make sure to choose a good payment gateway is that provides different currencies for different payments worldwide.

Conclusion

As a business owner, you should know that providing a secure, smooth, fast, and trustworthy payment gateway, with a good and friendly user interface is one of the keys for long term success of your online e-commerce.

A good payment gateway should offer multiple transaction facilities (debit cards, credit cards, wallets, etc.) on the website and a mobile app alike.

The payment gateway plays an important role of boosting customer buying experience, and leaves a good impression on the e-commerce website or app.

If the payment experience is not good, your business will lose customer trustworthiness and sales will drop.

Recent Comments